Free Cash Flow Yield Private Equity. What is fcfe (free cash flow to equity)? Requirement (a) as at 1 january 20x4, prepare a schedule of.

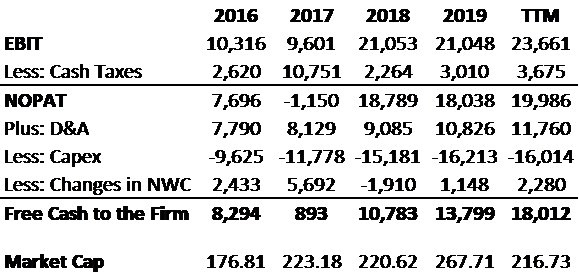

Venitra’s cfo believes the best way to find the fair value of the shares is to discount the forecasted free cash flows of the firm, assuming that beyond 20x7 these will grow at a rate of 3% per annum indefinitely. Please let me know if you need specific modifications in the model or place a. Private equity and investment bankers do not build separate financial models for each deal.

Free cash flow yield is a ratio wherein a fcf metric is the numerator and the total number of shares outstanding is the denominator.

Whereas dividends are the cash flows actually paid to. Requirement (a) as at 1 january 20x4, prepare a schedule of. Whereas dividends are the cash flows actually paid to. What is free cash flow to equity (fcfe)?